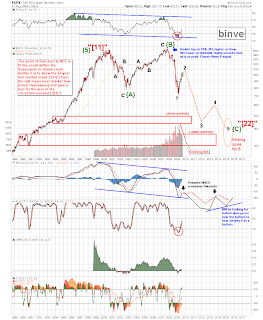

But Dayton and I were having a discussion about the Elliott Wave count of the DGR. I have EW counts of several important ratios, but I did not have one for the DGR.

Here are the counts, and I have several notes that follow:

You can see that I point out on the 200 year chart that equities will represent a tremendous value, as an asset class, in real terms when the ratio bottoms. In real terms because the price of gold represents the true inflationary impact of the US monetary policy. But I also think we will get a bottom in the Dow in nominal terms as well somewhere around this timeframe.

From The Long View - Aug 27, 09

And I do not refer to equities being an excellent value sarcastically. I am quite serious. I am not bearish on equities for the sake of being a bear, nor am I holding gold because I like shiny objects.

I want to maintain my purchasing power as we go through this next period of massive inflation while stocks continue to fall due to poor fundamentals. But eventually I want to trade my gold in for something useful and productive, because I believe the worlds economies will recover.

There are two relevant topics that I have written in the past that summarizes this view:

1) -- A response I have written many times regarding investment in Gold, and why I consider investing in Gold an optimistic endeavor.

In my investment account that I am in gold and oil. Why? Because I am bullish on the very long term prospects for the economy of the US and the world.

.... Now that might seem odd, because aren't all the people who invest in gold assuming the world will end? The answer is no, at least for this gold investor. I invest in gold not because the world might end, but I invest because I firmly believe it WILL NOT!!. If I was uber-bearish for the very long term, I would build a bunker underground, stocked with years of food and buy guns. Gold? For the end of the world? It makes no sense. Why would a useless shiny metal rock be something to collect if civilization ends?

It is the same thing with fiat currency (such as the US dollar). If you really thought the world would end, why collect little pieces of green paper with faces on it? How is that possibly useful? If there is no government to give you goods in exchange for it, then there are better items for a bunker mentality.

So I invest in gold because I am an optimist.

I am not bullish on the US government. I think they will inflate the dollar into worthlessness (or devalue it highly at least). But ultimately economies WILL recover, and I want to trade my gold in for something useful. Shares in a profitable alternative energy company, or a company the produces / distributes water from seawater to sustain drought countries, or any number of productive future endeavors.

Gold is simply a way to maintain purchasing power as the worlds economy goes through this large and needed contraction. So as an optimist, you should invest in gold :) Just my $0.02 (silver coins of course, not actual pennies ... :) )

2) -- I am including the preamble that I wrote to this blog post: Steve Saville: Gold and Saving. The preamble is also very relevant to this blog post. But follow this link and read this post, it is a very good article by Steve Saville.

Inflation (monetary inflation) is the selected course of action. Always has been, always will be when it comes to the Government, Fed and Treasury. Prices of many asset classes have fallen and will continue to fall, and this in and of itself is *NOT* deflationary. But the Fed (and analysts like Krugman) continue to pepetuate the myth that price deflation = deflation ... which is WRONG! These "deflationary" events are deflation scares in which the Fed is given free reign to drop rates to 0% and monetize debt like there is no tomorrow, due to popular (and intentional) misconception about deflation and thus public acceptance of these polices.

So, binv, asset prices are falling. Why do I care about the academic distinction between monetary inflation / deflation and price inflation / deflation?

Because monetary inflation or deflation beget vastly different long term consequences!

It is cause and effect. Monetary inflation not only enters into the economy unevenly but also changes the structure of the economy. Non-productive enterprises are propped up (especially government spending). But the biggest difference will be the price of real goods, such as commodities and especially gold, will reflect their real costs (inflation adjusted).

Many take this argument to support the theory that inflation will help stocks, as a general asset class, to maintain their levels. The only thing inflation will do will be to help stock from falling as far as they otherwise would. Please read this post for my explanation as to why: binve's Long Term View

Even in an inflationary environment, there are several asset classes that will continue to fall due to poor fundamentals. This is a demand issue and is not necessarily deflationary.

But there is one asset class that will maintain purchasing power through this period of massive inflation: Gold.

Notice my wording. Maintain Purchasing Power. Gold is *NOT* going to the moon! Anybody who thinks that does not realize what gold is. If gold goes to the moon, it is because the dollar goes down the the Earth's core. It _maintains_ purchasing power.

Gold is about holding value. Gold does not pay dividends, gold does not multiply, gold does not make the world go round. Gold holds value. That’s it. So gold is not a way to get rich. Let’s be very clear about this point. Gold is a way to be NOT POOR. Like I said, it holds value.

So if it goes to $5000/oz, it means that the economic toilet paper we call the US Dollar has been ravaged / devalued by the polices of the US Government, the Treasury, and the Federal Reserve. And you can now buy that much less with the Dollar.

The problem is debt.

And the Fed has made it very clear that monetizing as much debt as is necessary to keep the system going, at the direct expense to the Dollar, is not only a course of action that is open to them, but THE course of action that they are taking and will take. Anybody who does not understand and accept this is a bit naive (IMO). This plan will continue until there is no longer a Federal Reserve.

And as Saville is pointing out, the fact that the population is becoming wise to this is a natural and not at all unforeseeable consequence. Savings is increasing. And yes, for many people, that means into gold too.