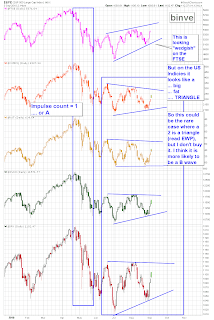

1) FTSE

As Blankfiend rightly observes, the FTSE made a higher high today above it Aug high, and also closed above the Aug high close. This is decidedly not bearish. So if the FTSE is headed down (eventually), the count needs to look something like this .... and it is ridiculous. We will see.

So the question is: Is a bearish September in our future? The FTSE sure doesn't think so.

1a) FTSE alternate count

There is a lot to hate about this count. But it is viable in the fact that it doesn't break any rules.

I don't really buy it, but we will see.

2) SPX - LD issues

Here is why I don't buy either Leading Diagonal count option for the SPX. Just because I don't buy it means precisely squat. It might turn out to be a LD just so the market can kick my face in.

... But no sir, I don't buy it.

2a) SPX - My preferred impulsive count

3) Index Examination

This is very interesting. We could be setting up for an A impulse down from Apr-May, B triangle from June-Sept, and then a C impulse down for Sept-Oct for the 'Fall Classic' (per Bob Hoye). So it wouldn't be P3, but a large correction for the intermediate term just the same.