-----------------------------------

Did you read that right? Did I write that right? How does that make any kind of sense? Well it does (in a weird, binv-sense way) make sense, which I will expound upon in a moment. This post will delve into a bit of FA, some sentiment indicators, and TA of several key markets. Not the micro TA, but big picture kind of stuff.

INTRO

I wanted to take a step back and look at the big picture. Take a breath. Stand up and take a look around. This will be a departure from the minute charts and micro counts of my recent series of posts. I will return to those soon, but I just wanted to share some observations this weekend regarding the “bigger picture”.

So let me first say that I am not a bear because I want to be, I am a bear because I think that is the long term direction that the market is headed. I believe we are in a secular bear market. I tend to look at “green shoots” and other positive economic developments skeptically, and not take the positive spin that usually accompanies it. This isn’t to say that there aren’t some genuine positive developments out there economically speaking. There are. It’s just that, on net, the negative developments are bigger and there are more of them.

Fundamentals and Technicals can diverge, and sometimes they can diverge in a big way. But they can’t very diverge for very long (relatively speaking). Nothing goes up and down in a straight line. And even in a really bad bear market, we will have bullish corrections. In fact, we can a very strong bullish correction that will seem like we are in a new bull market. Maybe your “investing” timeframe is only a couple of months at a time. In this case the term secular has little to no meaning for you.

But many at this site are the traditional “investor” types. LTBH, multiple decade investing horizon, buy it and forget it, etc. And so what this post is really aimed at is those who think or are beginning to think that we are in a new “secular bull market”. We are in a bull market right now. Just one that will end in the next couple of months. I will explain in a minute.

FUNDAMENTALS

Why we are in a long term “secular” bear market.

I have discussed this in many places and have remarked on this in many blog posts. I will refer you to this post for the majority / fleshing out of my argument Still Bearish: FA and TA on S&P500, Observations on the Economy May 10, 09 - LINK.

But let me summarize briefly here:

- Consumer spending makes up 70% of GDP

- Consumer is getting squeezed

- Consumer is spending less

- Consumer, despite spending less, are still losing their jobs

- Unemployment is rising (despite pauses / minor corrections in the rate)

- Consumer are therefore defaulting on mortgages

- Much mortgage debt has been “monetized” by the Fed via the bailout / takeover of Fannie and Freddie

- However a brand spanking new wave of mortgage defaults are occurring – Option ARM resets

- There is still so much bad debt hanging over the economy and much of it will be either defaulted upon or monetized (and despite what the Fed or Keynesians tell you, is not a significantly “better” option)

- Monetization has been an overused band-aid, and is now saturated with the dripping puss from the economy (sorry to be so graphic). The is done to avoid short term pain, but is destroying the value of the US Dollar

- A currency crisis in the Dollar is almost inevitable at this point

- Look at the Treasury market for a clue. During the deleveraging crisis in 2007-2008, safety was sought in Treasuries, now at bubble proportions. Since the subsequent Quantitative Easing (fancy / almost misleading term for monetization) and the value of the Dollar has been further depreciated, will Treasuries continue to be the save haven during the next crisis?

- Going back the consumer for a minute: consumers spend less which hurt business, but also the government

- Tax Revenues are Down

- Municipalities and States are insolvent and on the verge of bankruptcy

- What will happen: Denial of Services (social unrest) or will they get bailed out by the Fed and Treasury (further monetization of debt)

- GDP: The biggest growth sector is … the government

- The government does not have a wealth, all it has are claims on future tax revenue of US citizens and debt that it can sell to foreign governments (more in a minute)

- So when the government grows it is not growing the GDP truly. Any effect is temporary because it is paying for it through deficit spending or dollar devaluation (or both)

- Which mean in real terms (in devalued / inflation-adjusted dollars) GDP is severely contracting.

- China is not growing as strongly or as sustainably as many suggest: Steve Saville: Getting Some Things Straight Regarding China

- If China continues of the path of holding the yuan fixed relative to the dollar, it will have it is own inflation nightmare to begin with (read article above for explanation)

- China will likely need to stop purchasing new US Treasury debt at the levels they used to (it is unclear what they will do with their current US holdings, but they have already begun rotating into commodities)

- This means the Fed will have to continue to step up buying US Treasury debt (to keep interest rates low so that we can “borrow our way out of this mess”).

- This further debt monetization further undermines the dollar, and furthers the likelihood of a currency crisis in the dollar.

- Businesses are by and large NOT doing well

- The past 2 quarters have seen earning growth relative to the previous quarter.

- Revenues for leading companies have grown slightly (relative to previous quarter), but across the board, they are mostly flat or down

- Compared to a year ago, earnings and revenues are in the toilet.

I could go on and on. But you get the picture. The outlook for any “true” GDP growth (that is growth that is not driven by government spending) is bleak due to all the points made above.

The problem, as you have surmised, is debt. There is simply too much of it. At the core, this is the issue that must be dealt with.

And there are 2 main options: default or monetization. Based on the track record, what do you think will happen? However, either way we have a currency crisis. And either way, this spells bad news for both the US Dollar and Equities

Enlarge

THE GREAT DELEVERAGING EVENT OF 2008, AND WHY NEARLY ALL THE GLOBAL EQUITY MARKETS HAVE BEEN POSITIVELY CORRELATED RECENTLY

Money moved out of equities and commodities in a big way and into Treasuries, which de facto means into the US Dollar. The US Dollar did not gain the last 8 months because it was strong. On the contrary, due to all of the points made above, it has become substantially weaker.

But like I said at the beginning of the post, even within a long term secular bear market (which the Dollar is in), there will be bullish corrections – Thoughts on the US Dollar, Analysis of the USDX Long Term, Follow up on the Gold Blog Jun 17, 09 - LINK. Please read this for more thoughts on the US Dollar (I think it is worth your time if you have not already done so).

So all of this money sloshed around the system and into Treasuries. And via Sovereign Wealth Funds and other institutions, they stepped in during historically oversold conditions and went long. In nearly all of the markets. It is really uncanny (well not really, once you think about how the money is moving around). We did rally because we found a bottom, or because the economy is improving, or because the market was “priced for Armageddon” (a phrase that I love, but is ultimately incorrect). It was due for a technical bounce, pure and simple. Nothing goes up or down in a straight line and all rallies or declines must have corrections. We have no bottom, no new secular bull market. We have a cyclical bull market correction in a secular bear market. The fundamentals and the technicals diverged because a correction was needed.

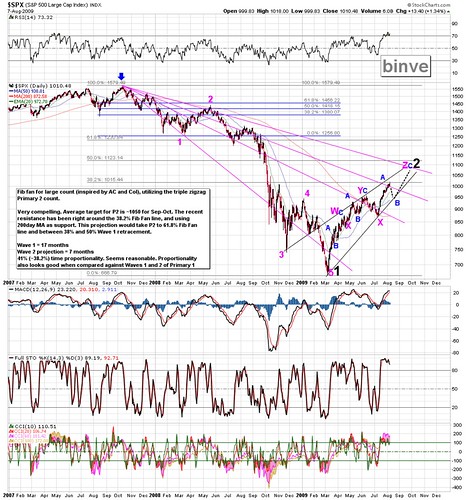

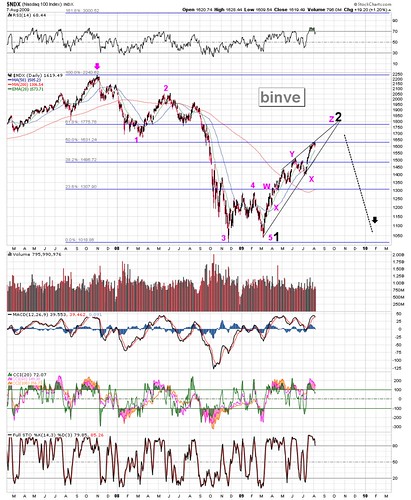

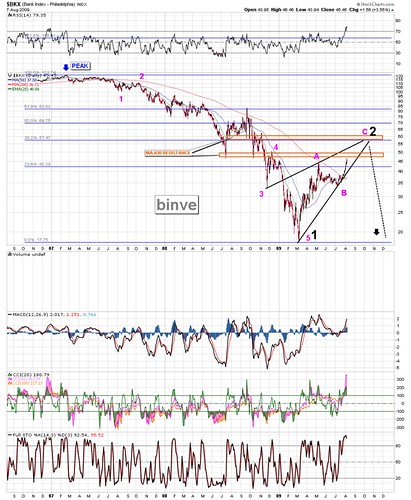

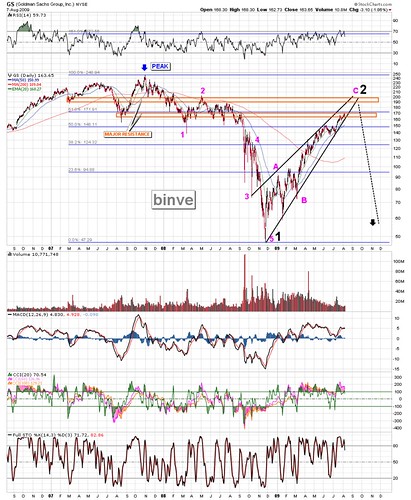

So before I get into some charts, let me talk about a term that I have mentioned before: Primary Wave 2. This is an Elliot Wave Concept. In any 5-wave sequence there are 3 waves that act in the direction of the trend (1, 3, 5) and two countertrend waves (2 and 4). I believe we are in a Cycle Wave pointed down (the secular bear market I keep referring to). Based on the Fundamentals, and the fact that all of the government actions have not fixed anything, and have in fact guaranteed that the long term consequences would be worse, I still stand by my opinion that we are in a secular bear market. This large Cycle Wave is a 5 wave sequence. Primary Wave 1 (the subwaves of a Cycle-degree wave are Primary-degree Waves) lasted from Nov 2007 to March 2009 (in most indices, the timing is off a little in some of the sectors). The current “bull market rally” is simply Primary Wave 2, which is counter to the prevailing trend of the current Cycle Wave.

This is why I say we are not in a new secular bull market. The fundamentals do not support it. And the Wave structure does not either.

There are some characteristics that Elliott (and then Frost and Prechter later) put forth that would describe some of the technical, fundamental and sentiment aspects of Wave 2. Here are some of those (modified to be bullish, as this Wave 2 is bullish):

From EWP: “Second Waves often retrace so much of Wave one that most of the losses endured are gained back by the time it ends. At this point investors are thoroughly convinced that the bull market is here to stay. Second waves typically end on very low volume and volatility.”

Additionally, bullishness sentiment returns, and is often as high as it was at the peak, despite the technical long term damage that was done by Wave 1.

As you look through the charts below, and especially the long term chart, keep these concepts in mind

The charts

A few things to notice on the charts below (in the context of deleveraging as indicated above): look at the synchronicity of the move down in the indices across the globe, as well as the bottoming and the bounce back up. In particular, look at the “shape” of how the markets have bounced back up. (For those of you who know a bit about TA, a rising wedge should give you a very clear signal). Additionally, look at how these indices appear to be drawn to particular Fibonacci retrace levels. But most importantly, notice how the trend lines converge and notice how they all seem to converge around the same time …. September to October of this year.

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

So, this should open your eyes to how connected these markets are right now (AND THEY SHOULD *NOT* BE), and how the global money moves are effecting these markets simultaneously. I also have two more shorter term charts. These help to illustrate that even though the rallies have taken different shapes since the bottom, they still point to the same conclusion

Enlarge

Enlarge

SENTIMENT

Getting back to the sentiment concept of Primary Wave 2. Since P2 is just a bullish correction in a secular bear market, it makes it the ultimate bull trap (in a long term / secular sense).

The “illusion” of a new secular bull market will be extreme. Bulls will come out of the woodwork. Bears / shorts will be squeezed. There will upside capitulation.

Even in the CIL, I am hearing statements from long time bears that the current price levels are “the last chance for the bears”. These types of statements are *extremely* characteristic of a Wave 2.

Nearly everybody will doubt the possibility of more downside, that a new bull market is here to stay.

I have been looking at bullish sentiment indicators via Barrons, WSJ, etc. Bullishness is rising, but it is not manic yet. I think about 1-2 more months should do it based on the current trends. And again, that fits with timeline for the wedges that you see on all of the charts above.

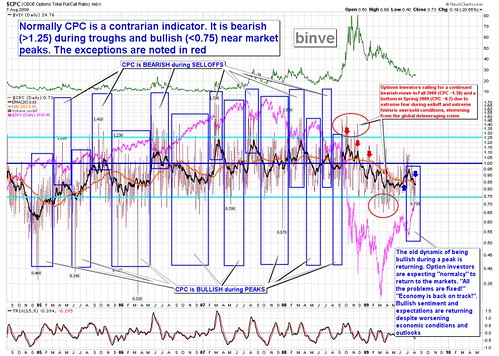

Here are the CPC and the Bullish Percentage for SPX charts. Read the notes of the charts

Enlarge

Enlarge

TYING THE POST BACK INTO THE TITLE

So, the theme from the sentiment section is that everybody gets squeezed. Bears will be crying uncle. The bulls will be parading out “green shoots” and “signs of an economic recovery”. Many bears will doubt their positions and capitulate upwards.

I firmly believe this is *not* a new secular bull market. I don’t believe it fundamentally and I don’t believe it from a long term wave count perspective either. In fact I believe this bull market move since March will be over in October based on all the charts above.

But I think we get one more fairly big rally out of it in September.

So if you are bearish, for a trade, why not capitulate to the upside for the blow off top for P2 ? Once everybody turns bullish, then we can end this correction and get back to economic reality.

**LET ME BE VERY CLEAR** I am not bearish for the sake of being bearish. I am bearish because of the long term technicals, wave counts and fundamentals. I do not want people to lose money who are long. On the contrary, I hope this post is read by LTBH-types, who have recently become un-scared enough to jump back into the market from the long side. DO NOT BUY IT AND FORGET IT WITH THIS RALLY. IT IS A BULL TRAP !!.

There is still upside to be had, but I think the very long term risk / reward is not upside from here. I think it is down … a lot.

Enlarge

But if you have to be long (and I am) from an investment standpoint, I would highly suggest gold and commodities. These are investments for me. I will hold them for years if not decades, as the US economy takes its next nose dive. I don’t do it because I want the economy to tank, I invest in hard assets / real assets because I have seen no compelling argument that it will not tank over the long term. Please read this for more of my thoughts on gold: Market Thoughts and Analysis: The Gold Blog. Gold/Silver/GSMs (and a little Oil for good measure) Jun 15, 09 - LINK

Please feel free to comment, disagree, discuss. And even if you don’t agree with my conclusions, please rec if you appreciate the effort or the explanation of my thoughts, even if you use them draw different conclusions than mine.

The binv standard disclaimer: This in no way constitutes investing advice. All of these opinions are my own and I am simply sharing them. I am not trying to convince anybody to do anything with their money. I am simply offering up ideas for the sake of discussion. As always, everybody is expected to do their own due diligence and to ultimately be comfortable with their own investing decisions.

interesting to see the futures dip to about 985 in the pre today, thinking that may be the morning low today too and ready to get back on the long side. this market has been eager to see a pb all the way up and may as well expect one. Bears always have a reason to think it is the end, but truthfully, i dont think the recent news flow actually changed what the "market" thinks yet or what it will do.

ReplyDeleteTradeing with mildly bullish tilt but finger on the sell button