In order for that to happen, there is some background information that is needed, which gives the order in which I have reached my conclusions:

1) Not All Five-Wave Moves Are Impulses: A Short Treatise on Elliott Wave

2) Another Impulse Wave Study: A Look at the 1974-1975 Low and Rally

3) Historical Count: 2002-2007

4) Five-Wave Structures Revisited: The Identification of an Impulse Wave

5) The Large Count with Historical Perspective

6) The Large Count with Historical Perspective (Part 2)

7) Macro Thoughts and Observations. Is the Bear Market Dead? Is this the Start of a new Secular Bull Market?

8) Bear Market Momentum Internals: Examination of Moving Average 'Price Stretching'

9) Lessons (To Be) Learned... again.

First we start with the last major impulse wave, which was the Supercycle impulse from the end of the Great Depression until the 2000 market peak. I discussed those counts in Another Impulse Wave Study: A Look at the 1974-1975 Low and Rally

The previous Supercycle Degree Impulse (1933-2000)

The previous Cycle Degree Impulse (1975-2000)

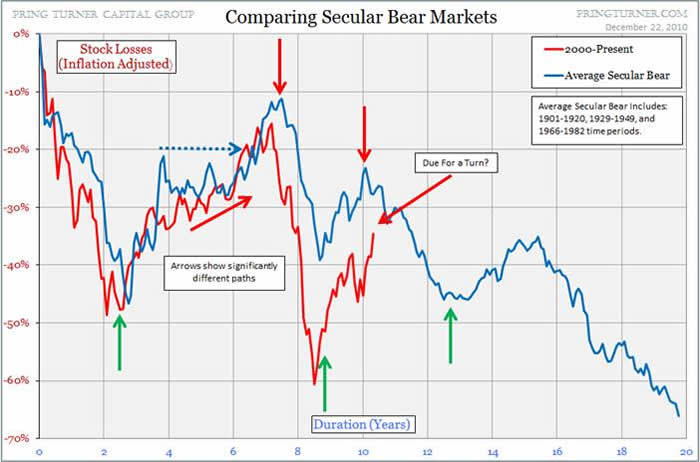

Next is the comparison of previous secular bear markets that have a similar character to the bear market that I believe we are experiencing now. From The Large Count with Historical Perspective

This leads me to what I think this secular bear market could look like for the long term:

Next is the comparison of the form of the 1966-1975 bear market to the current ongoing secular bear market. From: The Large Count with Historical Perspective (Part 2)

Here are some additional studies looking at the similarities of the momentum internals between the 1966-1975 bear market and the current secular bear. From: Bear Market Momentum Internals: Examination of Moving Average 'Price Stretching'

The 1966-1975 Bear Market:

The 2000-20xx Bear Market:

Finally when I smash all that together, this is how my secular bear market projection fits within the historical context:

There are a few things to notice here. I am differing from the view presented in Frost and Prechter: The Elliott Wave Principle where the Great Depression was actually a Supercycle 4th wave. I don't like that idea. Two's are very often the sharp, fast and deep retrace waves, and Four's are commonly the sideways waves. We even see that behavior in the wave form at the Cycle Degree from 1933-2000.

Columbia and I have talked about this before, and I believe we are thinking along very similar lines. We have some differences in our large counts (here are his latest thoughts on the long count), but the overall jist is similar.

Whatever count precedes the 1929 peak (and there are many theories on it, absolutely no one has a 'lock' on that count), I think we are still in a Grand Supercycle impulse. And I think we are in the 4th wave of that impulse. And yes, in the historical context, I think this will amount to a relatively sideways wave.